Car insurance policies often include coverage for car seat replacement after an accident. This coverage is typically part of the comprehensive or collision insurance.

Car seats play a vital role in protecting children during vehicle collisions. Recognizing this, many car insurance policies provide coverage for car seat replacement following an accident. This is not just a generous gesture but a safety necessity. In the event of a collision, even if the car seat appears undamaged, its integrity could be compromised, reducing its effectiveness in protecting a child.

Different states have varying laws regarding car seat accident replacement. It’s essential to be aware of these regulations as they can influence insurance claims. For instance, the National Highway Traffic Safety Administration (NHTSA) recommends replacing car seats after a moderate or severe crash. This recommendation is often echoed by car seat manufacturers like Graco, who may offer replacement programs for seats involved in accidents.

The condition of the car seat during the accident also matters. If a car seat was in the vehicle during an accident but wasn’t occupied by a child, its need for replacement might differ. However, safety should always be the priority, and replacing the seat is often advised.

After an accident, knowing what to do with the damaged car seat is crucial. It should not be used again and properly disposed of to prevent future use. For insurance claims, documenting the accident’s impact on the car seat is vital. This includes taking photos and noting any visible damage.

For those who have experienced an accident involving a Graco car seat or any other brand, it’s advisable to contact the manufacturer for specific guidance. They often provide detailed instructions and support for such situations.

To learn more about car seat replacement after an accident and how to navigate insurance claims, read the detailed article below. It offers in-depth insights and practical advice for ensuring child safety and making informed decisions post-accident.

Qualifying for Car Seat Replacement in Auto Insurance

The eligibility criteria for car seat replacement under auto insurance policies is crucial for any policyholder. Auto insurance policies vary significantly in terms of what they cover, and this includes the replacement of car seats after an accident. Typically, eligibility hinges on the specific terms of your policy, which can differ based on the insurer and the type of coverage you have purchased.

Most insurers require certain conditions to be met for a car seat replacement claim. These conditions often include the severity of the accident, the age and condition of the car seat, and whether the car seat was in use during the accident. Documentation is also a key factor in these claims. Policyholders are usually required to provide proof of the accident, such as a police report, along with evidence of the damaged car seat.

It’s also important to be aware of exceptions in coverage. Some policies may not cover car seat replacement if the seat was already damaged before the accident or if it’s past its expiration date. Understanding these nuances is essential for policyholders to ensure they are adequately covered.

Filing a Car Seat Replacement Claim: Step-by-Step

After an accident, the process of filing a claim for car seat replacement can seem daunting. However, understanding the steps involved can make the process smoother. Initially, it’s important to notify your insurance company about the accident as soon as possible. The time frame for filing a claim can vary, but it’s generally advisable to do it promptly to avoid any complications.

The required documentation typically includes a copy of the police report, photos of the accident scene and the damaged car seat, and any other relevant evidence. Communication with your insurance company is key throughout this process. They can provide specific guidance on their procedures and what additional information might be needed.

Insurance companies also consider the role of accident reports in assessing claims. These reports provide an official account of the incident, which can be crucial in determining the validity of your claim. It’s important to ensure that all the necessary information is accurately and thoroughly documented in these reports.

Comparing Insurers on Car Seat Replacement Coverage

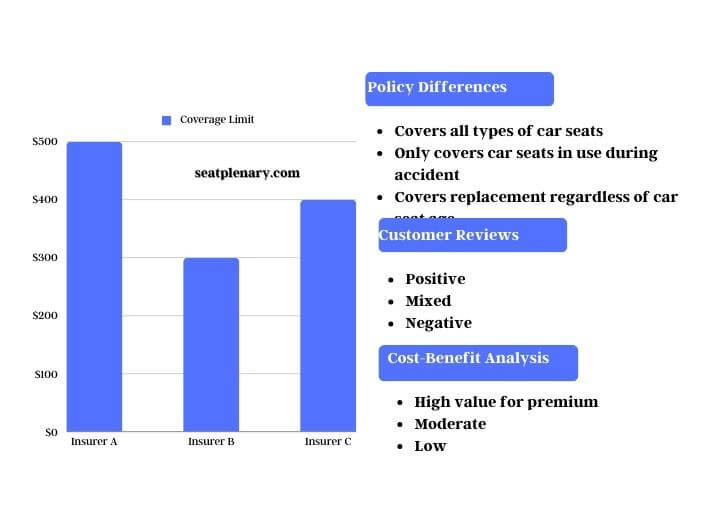

A comparative analysis of different insurers’ policies on car seat replacement reveals significant variations. To help policyholders make informed decisions, here’s a table comparing major insurers:

| Insurer | Coverage Limit | Policy Differences | Customer Reviews | Cost-Benefit Analysis |

| Kemper Corporation | $500 | Covers all types of car seats | Positive | High value for premium |

| American International Group | $300 | Only covers car seats in use during accident | Mixed | Moderate |

| Liberty Mutual | $400 | Covers replacement regardless of car seat age | Negative | Low |

This table illustrates the differences in coverage limits, specific policy conditions, and general customer satisfaction. It’s evident that some insurers offer more comprehensive coverage than others, and customer experiences can vary widely. When choosing a policy, it’s important to weigh these factors against the cost of the premium to determine which option offers the best value for your needs.

Age and Condition: Factors in Car Seat Coverage

The impact of a car seat’s age and condition on insurance coverage decisions is a critical aspect to consider. Insurance companies often assess the age of the car seat to determine if it’s within the manufacturer’s recommended usage period. Car seats that are too old or have visible wear and tear may not be eligible for replacement coverage.

Manufacturers typically provide guidelines on the lifespan of their car seats, which can range from 6 to 10 years. Insurance adjusters take these guidelines into account when assessing claims. They also consider factors like the car seat’s condition at the time of the accident and any signs of previous damage or excessive wear.

Depreciation is another factor that can affect coverage. Some insurers may reduce the amount of compensation based on the age and condition of the car seat, arguing that it has depreciated in value over time. Understanding these factors can help policyholders anticipate how their claims might be evaluated.

Legal and Safety Aspects in Car Seat Claims

Navigating the legal and safety considerations in car seat replacement claims is essential for compliance and protection. Car seats are subject to strict legal requirements and safety standards, which vary by state. These laws are designed to ensure that children are transported safely and are often referenced in insurance policies.

The National Highway Traffic Safety Administration (NHTSA) provides guidelines on car seat safety, including when to replace car seats after an accident. Insurance companies often refer to these guidelines when assessing claims. Compliance with state-specific laws is also crucial. Non-compliance can not only affect your insurance claim but also result in legal penalties.

Safety standards are another key consideration. Car seats that do not meet current safety standards may not be eligible for replacement coverage. It’s important for policyholders to be aware of these standards and ensure that their car seats comply with them to avoid complications in the event of a claim.

The nuances of car seat replacement coverage in auto insurance policies is vital for policyholders. From knowing the eligibility criteria and the claim filing process to comparing different insurers and considering the impact of car seat age and condition, each aspect plays a crucial role. Additionally, adhering to legal and safety requirements is essential for successful claims and the safety of young passengers. Being well-informed about these factors ensures that policyholders are prepared and protected in the event of an accident.

Read more: